Spot Churn Risks Through Voice Of Customer Call Insights

-

Kehinde Fatosa

- 10 min read

Losing a customer is never easy. Sometimes it feels like it happens out of nowhere, but most times, there are signs. Small frustrations, complaints, or issues customers mention during calls. The problem is, those warning signs get lost in all the noise.

That’s why listening to what customers say during calls is a goldmine. And even better, having a tool that spots churn risk automatically from those calls can save you from losing more customers than you have to.

What Is Churn Risk Analysis?

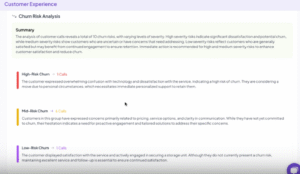

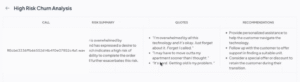

Not all complaints are equal. Some customers have small questions or minor issues, others are frustrated and ready to walk away. Our churn risk analysis takes calls and rates them by how serious the customer’s complaint is.

It groups customers into three categories:

- High Risk: These calls show big problems or frustration. These customers need immediate attention.

- Mid Risk: These customers have concerns or unresolved issues that could turn into bigger problems if not handled.

- Low Risk: Mostly customers with minor issues.

How Does It Work?

Behind the scenes, our platform goes through the call transcripts and uses smart analysis to detect words, tone, and patterns that point to customer frustration or satisfaction. This means you don’t have to go through thousands of calls hoping to catch the ones where customers might leave. The dashboard highlights the risk levels for you.

Why Should You Care About Churn Risk?

Because catching churn early means you can do something about it.

When you know which customers are at high or medium risk, you can:

- Reach out before they decide to leave

- Fix issues faster with focused support

- Spot trends in complaints to improve your product

- Save revenue by keeping more customers happy

What Does It Look Like on the Dashboard?

On the dashboard, you get a clear view of customers segmented by risk level. You can see how many high, mid, or low risk customers you have at a glance.

If you want to dig deeper, just click into any risk group and review the actual calls flagged. Hear the frustration, understand the problem, and prepare your team to act quickly.

Next Steps

Knowing who’s at risk is the first step. Here’s what to do next:

- Contact high risk customers immediately. Show them you’re listening and ready to help.

- Analyze common complaints. If many customers flag the same issue, it’s time to fix it.

- Coach your team. Use real calls to train support and sales reps on handling tricky situations.

- Share with product and marketing teams. Customer feedback from calls is invaluable for improving what you offer.

Frequently Asked Questions

How accurate is the churn risk analysis?

It’s based on analyzing real customer conversations and looks for clear signals of dissatisfaction. It gives you a strong early warning.

Can it catch customers who don’t complain loudly?

It’s designed to pick up subtle cues too, like tone changes or hesitation, that may indicate risk even if the complaint isn’t obvious.

How often does the dashboard update?

The data updates continuously as new calls are processed, so you always have fresh insights.

Bottom Line

Churn doesn’t have to be a surprise. When you listen closely to what customers say in their calls and use smart tools to spot risk, you get a head start on saving accounts before it’s too late.

Voice of Customer call insights give you a clear window into customer health, so you can act fast, keep more customers, and grow your business.