What is a Focus Group in Research: Focus Group Data Analysis

-

Bella Williams

- 10 min read

What is a Focus Group in Research?

If you work in marketing, product development, user experience, or any other customer-facing role, you’ve likely heard or asked “what is focus group in research” before.

So what exactly is a focus group? How do they work? And what value do they provide for research?

A focus group is a carefully planned discussion involving a small group of people whose beliefs, attitudes, experiences, and insights are relevant to the research topic at hand. The discussion is led by a trained moderator in an informal setting that is designed to spark insightful feedback and foster an open exchange of ideas.

Focus groups are a type of qualitative market research technique used across many industries to gain an in-depth understanding of a target audience’s opinions, motivations, preferences, and pain points.

They fill a critical role in customer/user research. This is done by uncovering the “why” behind people’s behaviors, needs, and decision-making processes – something that can’t be fully captured through quantitative methods like surveys alone.

In this article, we will examine the place of focus group in research and how to analyze focus group data. However, in the meantime, click here to analyze transcripts from your research.

The use of Focus Groups

• Testing new product concepts, designs, marketing campaigns, etc. prior to launch

• Understanding attitudes and perceptions around an existing product/service

• Exploring customer experiences, unmet needs, and points of friction

• Generating new ideas from engaged consumers/users

• Assessing reactions to things like pricing, branding, and messaging

At their core, focus groups provide businesses and organizations with a direct line of communication to their target customers or end-users. This first-hand feedback is invaluable for making more informed, customer-centric decisions during product development, marketing campaigns, user experience design, and beyond.

How Does a Focus Group Work?

The specific process can vary based on research objectives, however, most focus groups follow a similar basic format:

1. Recruiting

Participants who match pre-determined screening criteria (e.g. demographics, behaviors, experiences, etc.) are recruited through various channels. This ensures the participants are relevant to the research topic. Typical group size is 6-10 people.

2. Logistics

A facility is selected that has an observation room with a one-way mirror, as well as audio/video recording capabilities. The participants are brought into a controlled discussion room with a trained moderator.

3. Discussion Guide

The moderator follows a pre-set discussion guide covering specific topics and questions, but allowing for a natural flow of dialog. Guides are carefully structured to create an open environment for sharing thoughts and opinions.

4. Group Dynamics

One of the key strengths of focus groups is the ability for diverse individuals to share perspectives, build off each other’s comments, and spark new insights through triggered memories and associations. Skilled moderators facilitate these rich interactions.

5. Activities

To further promote engagement, moderators will often incorporate exercises, product samples, visuals, and other activities into the session. This could involve evaluating mock-ups, sampling products, or role-playing scenarios.

6. Observation

There is typically a one-way mirror or video stream where clients/stakeholders can observe the sessions live. This allows them to experience first-hand reactions and catch important non-verbal cues.

7. Analysis

After a focus group, recordings are reviewed and key insights are comprehensively analyzed using AI tools like Insight7. Reports summarize major themes, significant quotes, and strategic recommendations.

While there are many variables to conducting effective focus groups, some guiding best practices include:

• No more than 10 participants to ensure everyone can actively participate

• A skilled moderator experienced in managing group dynamics

• Comfortable, casual setting to facilitate open discussion

• Incentives for participants in exchange for their feedback

• A mix of question types (e.g. open-ended, projective, etc.)

• Incorporating interactive exercises beyond just verbal Q&A

The Role of Focus Groups in Research

Within the field of market research, focus groups occupy an important space in the qualitative research realm. They complement and enhance quantitative data gathered through methods such as surveys by capturing the much-needed context behind the “what” and revealing the “why.”

For example, let’s say a software company is preparing to launch a new enterprise product. They’ve surveyed hundreds of target customers to measure demand, assess feature prioritization, and gauge pricing sensitivity.

This quantitative data reveals important statistics like what percentage of people are interested in the product, which features rank as most valuable, and what the acceptable price range is.

But what those rating scales and multiple-choice questions can’t uncover is the reasoning and motivations behind why customers made those selections.

That’s where focus groups play a critical role –allowing the researchers to explore the underlying beliefs, experiences, hesitations, and use cases that inform those decisions.

What is Focus Group in Research?

Why do customers value certain features more than others? What problems are they really trying to solve? What objections exist that could prevent them from adopting the product? Whose opinions and perspectives influence their choices?

The live, dynamic nature of a focus group allows researchers to peel back the layers and uncover the rich personal context and stories behind people’s behaviors and preferences.

These real-world anecdotes and revelations not only provide strategic direction for developing better solutions, but also cultivate deeper empathy and understanding of the customer mindset.

At the end of the day, businesses are creating products and services for human beings – not just data points on a spreadsheet. Success hinges on being able to connect with target audiences on a deeper, emotional level.

Through their unique ability to facilitate open-ended dialog, focus groups play an instrumental role in humanizing the research findings and crystallizing a customer-centric point of view.

When used properly as part of a mixed-methods research approach, they serve as a powerful complement to quantitative data by capturing the authentic voices and personal perspectives that numbers alone cannot convey.

However, it’s important to note that focus groups do have some inherent limitations. Compared to many quantitative methods, focus groups:

• Involve small sample sizes that may not be statistically representative

• Can be influenced by social dynamics and peer pressures

• Can be susceptible to moderator bias based on how conversations are facilitated

• Are labor-intensive and time-consuming to coordinate, execute, and analyze

For these reasons, focus groups work best when triangulated with other research techniques like quantitative surveys, user interviews, field studies, and more. When integrated into a comprehensive research strategy, the unique context gathered from focus groups can exponentially increase confidence in key business decisions.

What is a Focus Group in Research: Conducting Focus Group Data Analysis

Once the logistical heavy lifting of planning, recruiting, and facilitating the focus groups is complete, researchers are left with a wealth of raw data to pore through and make sense of. Evaluating focus group data in a rigorous and insightful way is critical for deriving maximum value and surfacing clear action-oriented findings.

There are many different approaches to qualitative data analysis.

Here is a typical workflow for comprehensively analyzing focus group recordings and notes:

1. Data Preparation

The first step is to collect, organize, and prepare all the data from the focus group sessions. This includes:

– Video/audio recordings of each discussion

– Observation notes from the moderator and any other note-takers

– Transcripts created from the audio/video recordings

– Any documented materials used during exercises (e.g. worksheets, sticky notes, etc.)

Having consolidated files with consistent naming conventions will make analysis much smoother.

2. Listen/Watch Recordings

Before attempting to code or analyze the transcripts, it’s important for researchers to re-watch the video and/or re-listen to the audio recordings in their entirety. This enables the analyst to re-immerse themselves in the actual discussions and capture valuable context beyond just the text transcript.

Important things to take note of include:

– Tone of voice and emotional undercurrents

– Body language and non-verbal cues

– Moments of group consensus or disagreement

– Powerful verbatim quotes to highlight

– Particularly insightful commentary to flag

3. Analyze the Transcripts

With the recordings reviewed, the next step is to code the transcript data. Coding is the process of identifying relevant excerpts and passages, and categorizing them into universal themes and topics.

This can be done manually by physically highlighting transcripts and taking notes. There are also qualitative data analysis software tools like Insight7 that can streamline and automate this process.

Common coding techniques include:

– Deductive coding: Identifying quotes/passages based on pre-defined codes or topics

– Inductive coding: Allowing codes and themes to organically emerge from the raw data

– Values coding: Identifying instances of belief/value statements being expressed

– Versus coding: Comparing participant comments to highlight differences of opinion

The coding process should focus on surfacing common patterns and insights across the multiple sessions, as well as contrasting viewpoints and unique personal experiences shared.

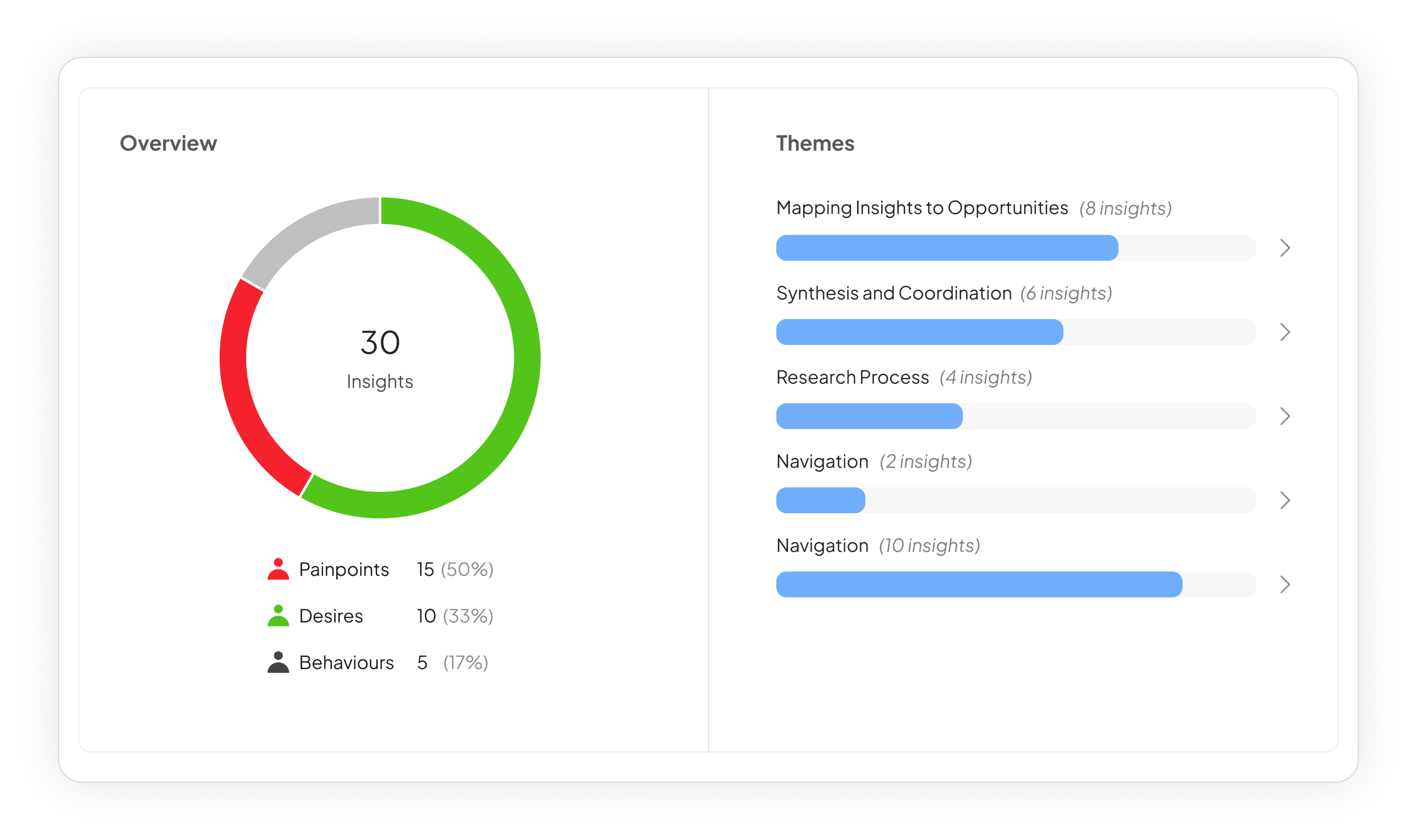

4. Identify Themes & Insights

With all the relevant data excerpts coded and categorized, analysts can then step back and synthesize the broad overarching themes that bubble up across the focus groups.

Some examples of common themes could include:

– Unmet needs and “pain points” expressed

– Desired product features or service enhancements

– Objections, hesitations, or concerns raised

– Distilling core motivations, attitudes and drivers

– Journey maps of the end-to-end user experience

An important next step is to dig deeper and interpret what these themes mean to the specific research objectives. This entails layering in additional context based on the researchers’ expertise to generate specific insights and recommendations.

For example, a theme of “desiring more personalized service” could inform strategic recommendations around optimizing staffing, improving training processes, leveraging new personalization technologies, and more.

Visual models like journey maps, affinity diagrams, and other synthesis frameworks can help make sense of these insights in an actionable way.

5. Report & Storytelling

The final phase of analysis involves compiling all the coded data, themes, insights and recommendations into a logical and compelling report. It acts as the master deliverable for disseminating the research findings internally and influencing strategic decision-making.

Effective reports don’t just regurgitate dry facts and statistics, but rather bring the research to life through clear data visualizations and captivating storytelling with participants’ own words and experiences. Immersive multimedia components like video clips of the sessions can make the findings even more impactful.

In addition to the comprehensive final report, consider creating shorter stakeholder-facing deliverables like executive summaries and PowerPoint presentations to facilitate discussion and socialization of the insights.

This is just one framework for analyzing focus group data. The overarching principles of thoroughly immersing yourself in the raw inputs, objectively coding & synthesizing, and thoughtfully storytelling your findings are essential for maximizing the impact of this research methodology.

Applications Beyond the Traditional Focus Group

Obviously, focus groups are most commonly used in market research for consumer products and services. However, their principles and best practices have been adapted for a variety of business use cases:

• User experience (UX) research: Focus groups with target users help evaluate app/website designs, product usability, and identify pain points in the customer journey.

• Employee engagement: Organizations can gain a better understanding of employee experiences, sentiment, and needs through internal focus group discussions.

• Healthcare: Focus groups explore patient journeys and caregivers’ experiences to uncover insights for improving medical services.

• Public policy: Government agencies and nonprofits use focus groups to gather citizen feedback and sentiment on topics like environmental policies, urban planning, public services, and more.

There are also variations on the traditional format, such as online focus groups that take place over web conferencing, mobile messaging focus groups using chat apps, or the inclusion of technologies like virtual reality/augmented reality.

The mediums and contexts may differ, however the core principle of fostering open-ended, insightful group dialog remains universal.

At its essence, a focus group is simply a means of better understanding your target audience by tapping into their unfiltered thoughts, feelings, and behaviors. In a world driven by data, they remain an invaluable research method by injecting human truths into business strategy and decision-making. Click on the link below to analyze your interview recordings and generate actionable insights.