As a product team or a startup, you need to collect market research data. This research can be carried out by the team or by a third-party researcher but can you generate insights from it?

The product team will realize that they do not know how to generate useful insight from the research data sets.

You see, carrying out research and analyzing the results are 2 separate things. In this article, we’ll look at how to analyze market research data to gain insights from it.

If you have market research data that needs to be analyzed and you’re not quite sure how to reach insightful conclusions, here are 3 simple questions you should answer:

1. Could we display the data in a more meaningful way?

The first question to ask when trying to gather insights from market research data involves how you are displaying the data.

When data usually starts as a spreadsheet of numbers, it can be difficult to see what the numbers really mean or to recognize patterns that exist.

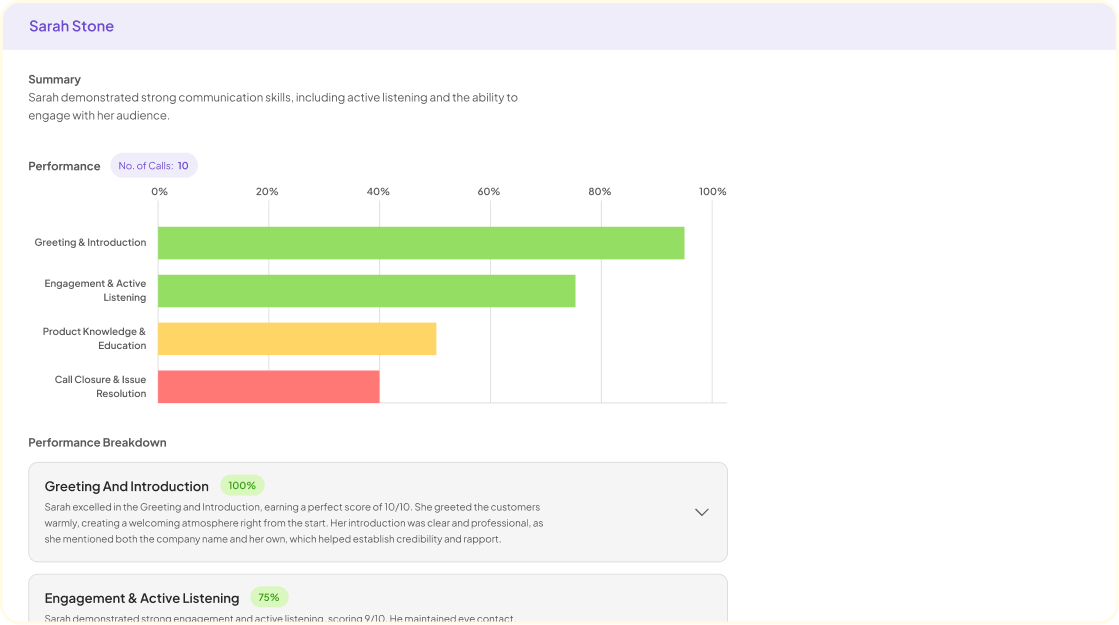

Therefore, start by organizing your quantitative data into graphs to see trends over time (ex. line graph or bar graph) or percentages of response frequencies (ex. pie chart).

Once you’ve identified interesting trends from your quantitative data, dive deeper into support qualitative data.

For example, if you see that 70% customers find the support feature of your website difficult to use yet all other features only have 5% of customers struggling to use them, this needs further analysis!

Through reading comments and follow-up written questions, you may find problems such as repeated error messages, a certain feature being too slow, too many fields need to be filled out before they can submit a ticket, etc.

💬 Ask About This Article

Have questions? Get instant answers about this article.

2. Are we just looking for what we want to see?

It’s important to remember that confirmation bias, looking for what you want to see, is a real and prevalent threat to usable market research insights.

If your market research has a particular goal in mind, be sure you’re not cherry picking data that confirms the particular goal.

You should also be wary of market research data that seems “too good to be true” because often times, it is!

Checking your sample size and statistical confidence are two good ways to start determining whether your research findings are simply up to chance or whether they are real.

3. Are we doing analysis just to analyze?

When doing market research, it can be easy to do more analysis than necessary because the analysis process is what you’re focused on, not the results.

While we do support meticulous analysis of market research data, you have to remember that experience, common sense and logic also play a huge part in data analysis.

So think through the graphs you’re creating and the in-depth analysis focus you choose to decide whether it is really necessary or whether you are just doing this analysis because you’ve been asked to analyze the results.

Reasons for analyzing market research

Here are some reasons to analyze market research:

- Helps with strategic planning: Analyzing your marketing research can help you draw conclusions about your company’s financial health and where you can continue to grow and improve, whether it be into new markets or with new initiatives. You can analyze the strength of each potential plan and determine the strategic benefits.

- Identifies trends: Analyzing your market research can help you identify patterns in competitors’ products and your own revenue to help you stay up to date with the changing needs of your customers. Depending on the timing of your analysis, you may be able to identify relevant trends before your competitors and stay ahead of the market.

- Clarifies your position: Analyzing your market research can help you place your product or brand in relation to your competitors. You can get a better understanding of what you offer compared to other brands or products, so you can clarify how to best position yourself to potential customers.

- Forecasts business projections: Analyzing your market research can help you create an idea of what the future of your business might look like. You can compare information about competition and trends with the expected results from your strategic plans to project future growth for your company.

💬 Ask About This Article

Have questions? Get instant answers about this article.