The Buyer’s Guide to Revenue Intelligence for One Call Close Sales Teams

-

Kehinde Fatosa

- 10 min read

In one-call-close sales – every call is the only call. There’s no follow-up sequence, no second meeting, no recovery email. You close or you lose.

This guide is for sales leaders evaluating revenue intelligence platforms built for that reality. It covers what to look for, what it costs, how to implement it, and how to measure ROI – so you can make the right call before you sign anything.

Table of contents

- What is revenue intelligence for one-call-close sales?

- Is your team ready?

- What should you look for in a platform?

- What does it actually cost?

- Benefits and drawbacks

- How to evaluate vendors

- How to implement successfully

- How to measure ROI

- Why Insight7

In one-call-close sales, the margin for error is zero. The moment a rep hangs up without a commitment, that lead goes cold – no nurture sequence, no follow up, no second shot. It’s closed or it’s gone.

That makes one call close sales (solar, insurance, home services, and telecom) fundamentally different from every other sales model. And it means the tools built for B2B enterprise teams simply don’t work here. This guide helps you find one that does.

What is revenue intelligence for one call close sales?

Revenue intelligence for one call close sales is the use of AI to analyze 100% of sales conversations, identify the specific moments where deals are won or lost, and give reps a way to practice and improve before their next live call.

Revenue intelligence for one call close sales is the use of AI to analyze 100% of sales conversations, identify the specific moments where deals are won or lost, and give reps a way to practice and improve before their next live call.

For one-call-close teams, that means answering:

- What do top closers do in the first 60 seconds that average reps don’t?

- Which objections are ending calls before the close?

- At exactly what point in the conversation are deals being lost?

- How do we get every rep closing like our best rep?

Traditional QA reviews 1 – 3% of calls manually. Revenue intelligence analyzes 100% using AI – identifying the specific moments where deals are won and lost, and giving reps a way to practice before they’re live.

Why most platforms aren’t built for your motion

The dominant tools – Gong, Chorus, Clari – are built for long discovery calls and multi month pipelines. For one call close teams they’re overpriced, too slow, and focused on deal progression rather than first call conversion. When your entire revenue opportunity lives in a single phone call, you need a platform that treats that call as the whole sales cycle.

Is your team ready?

Strong fit:

- 25+ reps, 1,000+ calls per week

- You close – or lose – on the first call

- Top reps outperform average reps by 2x or more

- Growing faster than you can train new hires

- Post-sale cancellations are eating into booked revenue

- Call recordings, a CRM, and a dialer with API access

Not ready yet:

- Fewer than 25 reps or under 500 calls/week

- No call recordings

- Managers don’t currently coach (technology won’t create a coaching culture)

- Leadership expects “set it and forget it”

Every point of conversion improvement in a one-call-close model is pure incremental revenue – no extra leads, no extra headcount.

What should you look for in a platform?

- First-call conversion analysis. Most B2B-focused call analysis platforms track deal progression – irrelevant here. Most calls that need to close on first engagement are consumer-focused. These types of calls need deep analysis of the call itself: where energy dropped, which objections came up, whether the close attempt landed. Look for platforms that treat the single call as the entire sales cycle.

- AI coaching with practice – not just analytics. Knowing a rep struggles with objections doesn’t fix it. Practice does. And not generic practice, roleplay and drills built from your actual calls, targeting each rep’s specific gaps. One rep loses deals on price. Another talks through the close. The right platform knows the difference and coaches accordingly.

- Objection-specific coaching. Your reps face the same five or more objections on repeat. The platform should identify your most common ones from real calls, build targeted scenarios around them, and track whether reps are actually improving.

- Manager workflow built for speed. Managers overseeing 10–20 reps don’t have time to dig through dashboards. Insights should surface automatically and coaching assignments should take minutes, not hours.

- Compliance monitoring. TCPA compliance, state-specific consent laws, and script adherence aren’t optional in consumer sales. The platform should flag violations automatically.

What does it actually cost?

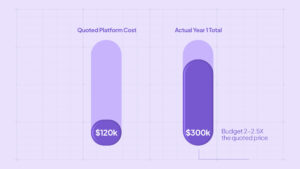

Vendors quote per-seat pricing. Reality for a 100-user rollout:

| Cost Category | Typical Range |

| Platform fees | $80K–$150K/yr |

| Implementation & integration | $10K–$50K |

| IT and RevOps time | $20K–$40K |

| Manager time | $20K–$40K |

| Change management | $15K–$40K |

| Year 1 Total | $150K–$320K |

Budget 2 – 2.5x the quoted platform cost for Year 1.

The hidden cost nobody budgets for is a failed implementation – low adoption, no ROI, then another $200K to migrate platforms 18 months later. Getting it wrong can cost $700K+ when you factor in lost revenue and management distraction.

Benefits and drawbacks

Benefits

- More closed deals, same call volume. A 1–2% conversion lift requires no extra leads, no extra headcount. It’s pure incremental revenue from calls you’re already making.

- Know exactly where calls break down. AI pinpoints the moment deals fall apart — weak opening, fumbled objection, poorly timed close — turning guesswork into targeted coaching.

- 100% of calls coached, not 3%. Managers stop flying blind. Every rep gets feedback, not just the ones the manager happened to listen to that week.

- Faster ramp times. New hires practice real objections from Day 1 instead of learning on live customers. Best-in-class teams see 25–30% faster time-to-quota.

- Lower cancellation rates. AI identifies the hesitation signals that predict cancellations before they happen, triggering retention intervention while there’s still time. A 10–20% cancel rate reduction can match the revenue impact of a 2% conversion improvement.

Drawbacks

Year 1 costs more than the platform fee. Budget accordingly or you’ll understaff the rollout.

- Results take 3 – 6 months. Teams that judge it at 30 days almost always quit too early. Set realistic timelines with leadership before you start.

- Managers have to actually use it. The platform surfaces insights – managers have to act on them. If coaching culture doesn’t exist today, build it before or alongside the rollout.

- 85% of failed implementations are people problems. Poor change management kills more rollouts than bad software. Plan for it.

How to evaluate vendors

The scorecard

Score each vendor 1–10. Identify your top 5 must-haves first – a low score on a critical criterion beats a high total with a gap where it matters most.

| # | Criterion | What to Verify | Score |

| Built for one-call-close | 3 customer references in your industry – if they can’t name them, you’re the guinea pig | /10 | |

| First-call conversion analysis | Does it analyze the call itself, or just log it? | /10 | |

| Same-day insights | How quickly after a call ends does it appear in the dashboard | /10 | |

| Dialer + CRM integration | Live demo with your actual tech stack | /10 | |

| AI coaching + objection practice | Watch a rep complete a real objection roleplay | /10 | |

| Cancel rate prediction | Can it flag at-risk deals from the original sales call? | /10 | |

| Manager workflow | Have a manager (not a vendor rep) demo their daily routine | /10 | |

| Verified references | 9+ months in, your industry, your volume — you call them directly | /10 | |

| Transparent pricing | Fully-loaded Year 1 cost in writing | /10 | |

| Pilot before commitment | 60–90 days before an annual contract | /10 |

80+: Strong fit. 60–79: Caution. Under 60: Keep looking.

Questions vendors hope you don’t ask

- “What does your platform NOT do well for one-call-close?” If the answer is nothing, end the call.

- “Show me first-call conversion analysis – not pipeline analytics.” Most platforms don’t have it.

- “What % of implementations stall in the first 6 months?” Industry average is 30–40%.

- “Connect me with a customer 9+ months in, in consumer sales.” Long-term customers tell the truth.

- “What’s your cancel prediction accuracy and how is it measured?” If they can’t answer precisely, it’s a demo feature, not a real one.

Red flags

- Won’t pilot before annual commitment

- Key features are “on the roadmap”

- Integration requires your team to build it

- All references are from the first 6 months

- Support is a knowledge base, not a human

How to implement successfully

Why rollouts fail

- 40% — No real executive sponsorship (budget approval ≠ active support)

- 35% — Poor change management (one kickoff, then silence)

- 15% — Wrong vendor for the use case

- 10% — Unrealistic expectations

The single biggest predictor of success: a sustained weekly cadence for 6+ months. Teams that maintained weekly manager reviews, coaching assignments, and public wins outperformed those that didn’t by 3x.

The four phases

Pre-launch (Weeks −2 to 0). Train managers before reps – they need to be confident, not learning alongside their team. Frame this as a development investment: “this helps you close more deals and earn more money” — not monitoring language. Reps under pressure will reject surveillance framing fast.

Launch (Weeks 1–4). Have reps use the platform during training, not just watch. Assign the first coaching task the same day. The fastest path to buy-in is a rep who practices an objection in the morning and handles it better on a live call that afternoon.

Adoption (Weeks 5–12). Maintain the weekly cadence without exception: Monday coaching focus, Friday public wins, one team-level data point per week. Miss one week and you spend two recovering.

Sustainability (Months 4–12). This becomes how you work, not the new initiative. Tie platform engagement to development and promotion criteria. Introduce advanced features in waves.

How to measure ROI

Ignore: calls analyzed, platform uptime, scenarios completed, accounts created.

Track these leading indicators:

- Daily active users (target: 70%+)

- Coaching completion rate (target: 80%+)

- Manager dashboard reviews (target: weekly, every manager)

- Rep NPS (target: 50+ by Month 3)

These are the actual proof:

- First-call conversion rate (before vs. after)

- Post-sale cancellation rate

- New rep ramp time

- Rep retention rate

The formula:

Incremental revenue = Reps × Calls/day × Working days × Conversion lift % × Avg deal value

ROI = (Incremental revenue − Total cost) ÷ Total cost × 100

Don’t overlook the cancel rate in the ROI calculation. A 15% cancellation reduction on a 40% cancel-rate team often adds as much revenue as a 2% conversion improvement – and typically shows up faster.

Conservative: 1.5–2% lift → 300–600% ROI

Realistic: 2–3% lift → 800–1,500% ROI

Best-in-class: 3–5% lift + cancel reduction + faster ramp → 2,000%+ ROI

Analyze & Evaluate Calls. At Scale.

Frequently asked questions

How is revenue intelligence different from traditional call recording software? Call recording captures conversations. Revenue intelligence analyzes them — scoring every call, identifying what top performers do differently, and generating personalized coaching. Recording is the raw material. Revenue intelligence is what you do with it.

How is Insight7 different from Gong or Chorus? Gong and Chorus are built for B2B enterprise sales. Insight7 is built for high-volume, one-call-close operations – same day insights, first-call conversion analysis, and coaching designed around the objections your reps face on repeat.

How long before we see results? Behavioral changes show up within 6–12 weeks. Meaningful conversion improvement typically follows at 3–6 months. Teams that judge it at 30 days almost always quit too early.

What’s the minimum team size to see ROI? 25 reps and 1,000+ calls per week. Below that, the data volume isn’t sufficient and the cost is harder to justify.

What happens to our data if we cancel? Negotiate this before you sign. All data should be exportable in CSV or JSON, available for 90 days post-cancellation. Any vendor unwilling to commit to this in writing is a risk.

Why Insight7

Testimonials

“It’s a great tool, and I am using it more everyday. The time to insight is impressive — it enables me to take customer interactions and turn them into insights I can act on.”

— Ryan Levander, Head of Analytics, Rednavel Consulting.”

Built for the one-call-close moment

Insight7 was built for teams where the entire revenue opportunity lives inside a single conversation. No complex setup, no waiting for weekly reports, no data analyst required. Connect your calls and immediately understand what’s working and what isn’t.

Revenue Intelligence

Funnel stage tracking shows how calls move through Opening, Discovery, Proposal, and Close in real time. Drop-off analysis pinpoints exactly where deals stall – with evidence pulled directly from the conversation. Winning behaviors surface what top closers do differently so you can replicate it team-wide. For one-call-close teams, this is the difference between guessing why conversion is flat and knowing exactly which moment to fix.

AI Coaching

Reps practice with realistic AI scenarios, receive personalized scorecards with specific coaching tips, and track skill development over time – without requiring a manager to be present for every session. In a one-call-close environment, reps need to have handled every objection before it appears on a live call. Insight7 makes that possible, on demand.

Automated QA & Scoring

Every call is evaluated automatically – talk time, words per minute, filler words, speaker balance, sentiment, and custom quality criteria, all scored the moment a call ends. Strengths and weaknesses are identified per rep, with coaching points backed by evidence. Managers stop reviewing a handful of calls and hoping they caught the right ones. Every rep gets feedback, every time – fast enough to use before the next call.

Security and compliance

SOC 2 certified · HIPAA compliant · GDPR compliant · Data encrypted at rest and in transit · Role-based access controls · Multilingual support

Analyze & Evaluate Calls. At Scale.

The call ends in minutes. The revenue impact lasts all year.

Every call is the only call. No recovery email, no follow-up meeting, no second chance. The teams winning in one-call-close aren’t working harder — they’re learning faster. They know what their best reps do differently, they practice the moments that matter before going live, and they catch at-risk deals before they cancel.