Validating B2B Concepts with Customer Discovery Interviews

-

Odun Odubanjo

- 10 min read

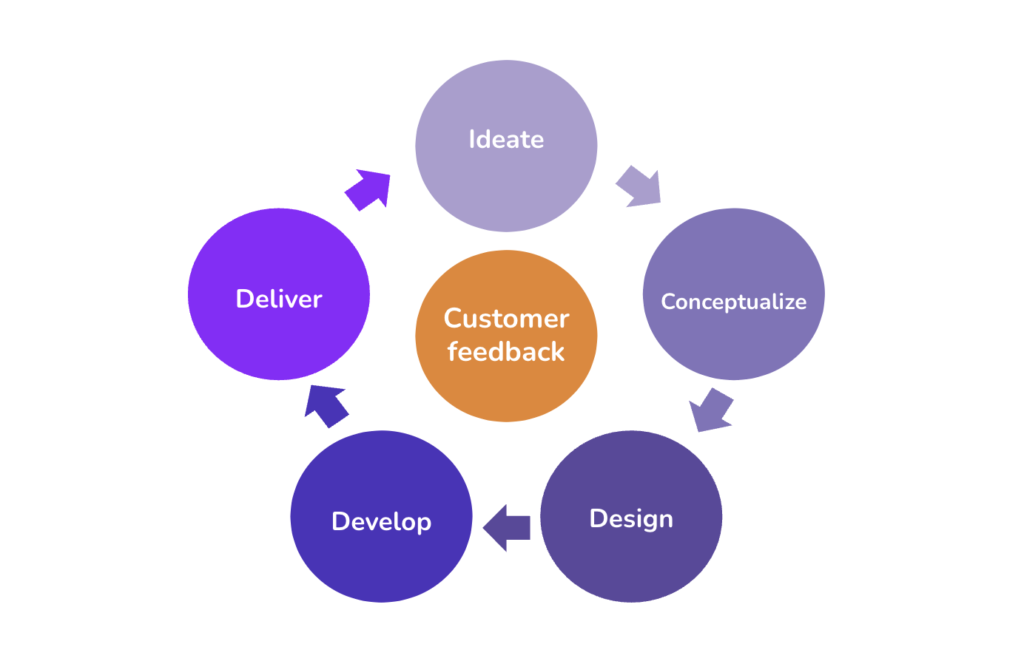

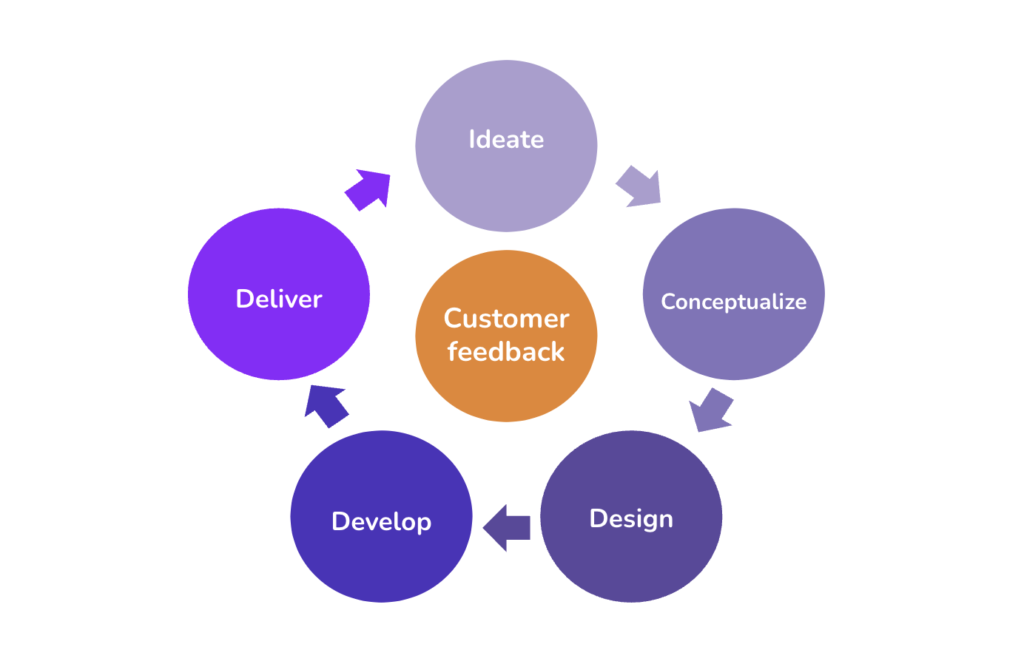

Customer feedback is critical for product discovery and delivery

Customer discovery interviews validate new business concepts prior to over-investing in execution. These short but highly insightful customer conversations enable organizations to gather real-world perspectives from intended users in order to identify core problems, evaluate potential solutions, and analyze product-market fit.

In the book “The Mom Test”, Rob Fitzpatrick emphasizes the need for conducting customer interviews to validate your business ideas. Good questions lead to great conversations, which lead to concrete facts that help you validate and iterate your idea.

While brilliant ideas and innovative solutions hold promise, validation through real-world insights is what separates promising concepts from market failures.

Launching an innovative new product or service carries substantial risk. Industry research indicates that 42% of B2B products fail due to lack of market fit and as many as 6 out of every 10 new product launches fail to meet revenue and adoption expectations. This high failure rate is often because companies pour significant time and money into ideas without effectively verifying customer interest.

Without a practical way to test whether your value proposition actually resonates with target users, it’s incredibly easy to spend months or even years building something no one wants.

What are Customer Discovery Interviews and how do they work

Customer discovery interviews are usually 30-45 minute semi-structured discussions with 5 to 8 representatives from your target business or consumer segments. The key goal is to filter and prioritize ideas faster while also reducing risk by understanding customer needs, wants, and preferences directly from the source.

While simply talking to potential customers is valuable, structured interviews elevate the process to a science. By following a pre-defined framework, you ensure consistent data collection and analysis, enabling you to:

- Compare and contrast: Analyze responses across different segments and personas to identify common themes and variations.

- Identify key trends: Uncover patterns and insights that wouldn’t be apparent through casual conversations.

- Quantify qualitative data: Use coding techniques to categorize and measure the frequency and intensity of specific themes.

Good interviewers can skillfully extract an immense amount of value from well-prepared discovery discussions such as:

- Direct customer quotes to incorporate into market research proposals, product requirements documents, and other plans needing stakeholder approval and buy-in.

- Revelation of common pain points and customer needs that can be addressed by new offerings.

- Testing which potential product features, messaging approaches, and value propositions actually appeal to users rather than relying on internal assumptions and guesses.

- Gathering feedback on optimal pricing models and willingness to pay thresholds.

- Receiving ideas on best go-to-market strategies and sales channels to deploy.

- Catching faulty assumptions early before over-investing in a direction not actually in demand.

Building Your Customer Discovery Interview Framework: A Step-by-Step Guide

Now, let’s translate theory into practice. Here’s a step-by-step guide to conducting insightful customer discovery interviews:

- Define your target audience: Identify the specific pain points and decision-making processes of your ideal B2B customers. Segment your audience if necessary to ensure tailored questioning.

- Craft a semi-structured interview guide: Prepare key questions aligned with your goals and the Mom Test principles. Include open-ended prompts, behavior-focused inquiries, and potential dealbreaker questions.

- Recruit participants: Reach out to individuals within your target audience through existing network connections, online communities, or professional platforms. Offer incentives to compensate for their time and ensure participation.

- Conduct the interviews: Create a comfortable and professional atmosphere. Actively listen, ask follow-up questions, and avoid solutioneering. Take detailed notes to capture key insights and responses.

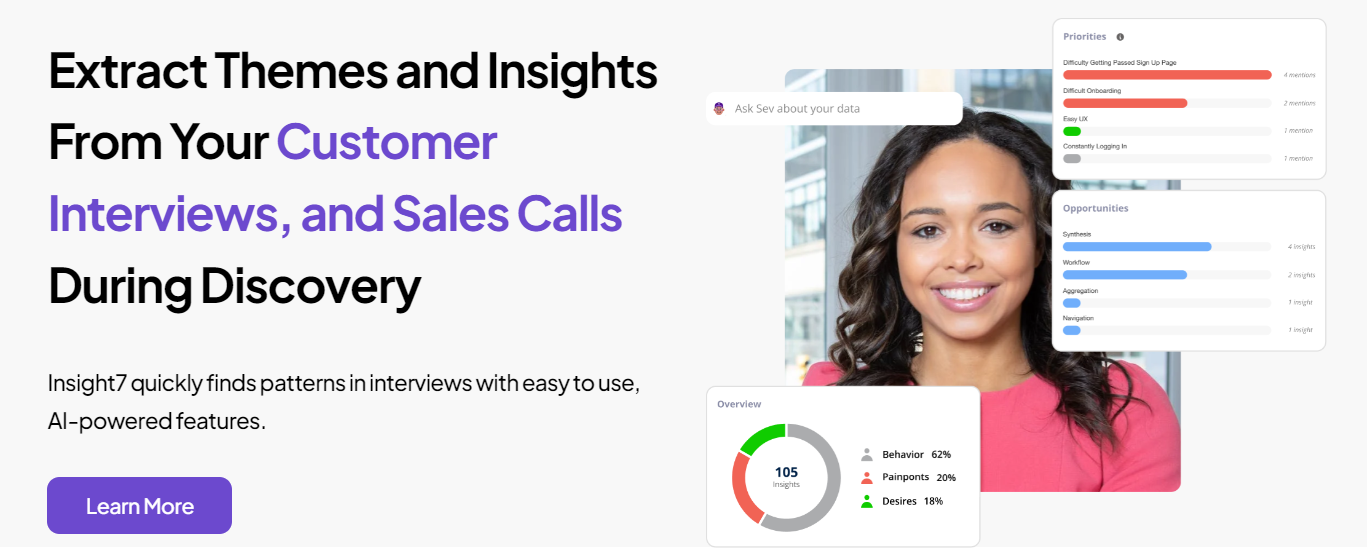

- Analyze and synthesize findings: Summarize key themes and common pain points. Identify discrepancies between assumptions and reality. Translate customer needs into actionable product or service features. AI tools like Insight7 do a great job at simplifying and automating this process.

- Iterate and refine: Use the gathered insights to refine your concept and prioritize features that address actual customer needs.

- Repeat and validate: Conduct additional interviews with different audience segments to ensure wider applicability and validate your evolving concept.

The Process: Conducting Effective Customer Discovery Interviews

While perhaps intimidating for some, conducting effective discovery interviews does not require complicated tools or a fancy setup. All you need is a recruitment screener template to find appropriate participants, an open-ended discussion guide with 5-6 strategic questions related to key assumptions you wish to test, and a notation template for capturing feedback, quotes, and insights.

With that said, how do you actually prepare for a good idea validation conversation?

Pre-plan the three most important things you want to learn from any given type of person. Pre-planning your big questions makes it much easier to ask good follow-up questions. Don’t be afraid to update the list as you learn and your questions change.

The less formal you can make the conversation, the better. Once you get used to this, you can start having these interviews with no formality at all, and the people you are talking to won’t even realize they’re being interviewed. For example, at a conference, you could have 10-20 of these conversations in just a few hours.

Here is a detailed overview of the step-by-step process:

- Clearly define your target customer profile and ideal buyer persona based on role, use cases, and other attributes. Personas may cover both end-user demographics as well as key decision-maker titles involved in procurement.

- Carefully craft an open-ended discovery interview guide organized around addressing major assumptions and knowledge gaps. Generally, start broad, incorporate follow-up probe questions based on initial responses, and close with numeric rating questions to quantify reactions. Leave room for open, authentic conversations while covering your research priorities.

- Recruit participant matches meeting your identified persona criteria via cold emails, phone calls, LinkedIn outreach, and by checking within your professional network for personal introductions. Explain why you wish to speak with them and what is in it for them based on incentives like gift cards for their time or access to research findings.

- Prepare customized scripts for interview probes and to address anticipated areas of concern ahead of time. But also remain flexible and conversational.

- Digitally send calendar invites for discovery calls booked as virtual video interviews for participant convenience.

- Take detailed notes within a consistent structured debrief template organized by research questions, capture verbatim quotes, document expressions, and highlight key themes.

- Thank interviewees for their participation and provide any agreed-upon incentives or share materials as promised.

- Collectively analyze results across multiple completed interviews with stakeholders to spot trends, identify patterns, and extract truly actionable insights rather than one-off opinions.

What Should Customer Discovery Interviews Cover?

Your customer discovery interview process can be either a hit or a miss easily. Referencing ‘The Mom Test’, to validate your ideas through customer interviews you must:

➔ Talk about the person’s life instead of your idea. The key to idea validation is talking to people to learn about them, their lives, and their motivations.

➔ Ask about specifics in the past instead of generics or opinions about the future. The past is more useful than the future! People are overly optimistic about what they will do in the future, which leads to lies.

➔ Talk less and listen more. The more you talk, the more you bias the person you’re interviewing.

💬 Questions about Validating B2B Concepts with Customer Discovery Interviews?

Our team typically responds within minutes

You should also remember to cover issues such as

- Current challenges, frustrations, and workarounds with existing solutions supporting related processes

- Assess general willingness and interest levels in adopting an alternative or new approach comparing the status quo way of operating.

- Share concept overviews and value proposition messaging to gauge reactions as well as suggestions based on respondent feedback.

- Review priority features planned and ask participants to rank relative appeal and which they deem non-negotiable.

- Probe around views on pricing models and thresholds for budget availability constraints.

How to find participants for customer interviews

Recruiting the right participant mix is crucial for reliable discovery findings. Beyond defining an ideal user profile, further, develop a sourcing strategy leveraging tools like ZoomInfo to identify contact information of prospects matching your target segment criteria.

There are several ways to generate customer interviews. You may need to start by reaching out cold, but the goal of cold conversations should be to get warm introductions to other people.

Reach out over email, LinkedIn, and even cold calls to explain why you wish to speak with them and the potential value for them in participating in a short 15-30-minute discussion. Make it clear you won’t waste their time. Explicitly ask for help. Be transparent.

Provide adequate incentives or compensation for their time if appropriate and helpful in securing conversations.

When you start cold outreach, remember that you only need one “yes” to get going. If you manage your interview right, that one yes will lead to a warm intro or three.

For additional qualified lead ideas, check within your professional network, partners, or existing clients for introductions to contacts reasonably aligned with your target demographic who may also be open to scheduling an interview. The key is being transparent on the purpose while keeping things as convenient and efficient as possible for target participants.

Translating Interview Insights into Action

As already established, customer discovery interviews offer invaluable data, but turning that information into action is crucial for maximizing their impact. Here are key takeaways to remember:

- Focus on the “why” behind the “what.” Don’t just understand what customers do, go deep into their reasons and motivations.

- Identify the jobs-to-be-done. Understand the specific tasks, goals, and desired outcomes your target audience seeks to achieve.

- Prioritize based on pain points. Allocate resources to address the most significant and widespread customer challenges.

- Embrace iteration and agility.

The true value of discovery interviews comes from collectively debriefing results across a series of completed calls to identify alignments and any outlier perspectives. Look for intersecting language, terminology, feature reactions, or model affirmations across multiple respondents. Give extra weight to repeating themes.

Carefully determine which key assumptions were definitively validated or fully invalidated so you can then further prioritize what hypotheses or approaches to double down on next via additional rounds of research or small-scale prototypes.

Additionally, focus heavily on listening closely to the exact choice of words and phrasing participants use when outlining their challenges, describing pain points, explaining workarounds, or assessing your value proposition. How they frame the problem often leads to naming convention improvements you can adopt in both branding as well as better conveying product positioning. Let this qualitative feedback guide messaging and communications moving forward.

Get a glimpse of Insight7 in action: Watch one of our 1-minute demo below.

Get Started for free today or Book a demo

Customer Discovery Interviews in Action

Leading innovative organizations have extensively utilized discovery interviews and customer co-creation to fuel fast product iterations and consistently delightful user experiences supporting sustainable growth.

By continually having frank customer conversations, they reliably gather the insights needed to open up new market opportunities, adapt existing features to be far more aligned to emerging user preferences, update go-to-market plans, and even uncover major manufacturing innovations.

Rather than later dealing with dismal retention and growth numbers totaling lost revenue in the millions, these teams wisely pivoted their entire approach to being far more user-centric based directly on that early qualitative feedback. A little upfront customer intimacy spared them considerable pains down the road.

The Bottom Line

Customer discovery interviews and ongoing customer co-creation efforts enable organizations to reliably build innovations and experiences people actually want and value. This reduces launch risks, accelerates cycle times, and drives sustainable client-funded growth.

Get Started for free today or Book a demo

💬 Questions about Validating B2B Concepts with Customer Discovery Interviews?

Our team typically responds within minutes