Customer Journey Map for Insurance Businesses

-

Bella Williams

- 10 min read

The Insurance User Pathway is crucial for understanding how customers interact with insurance services. Visualizing this pathway helps businesses identify key touchpoints where customers seek information, ask questions, and make decisions regarding their coverage. Each stage in this journey—from initial awareness to post-purchase support—presents unique opportunities to enhance the customer experience.

By mapping out the Insurance User Pathway, insurers can better anticipate client needs and streamline processes. This not only fosters trust and satisfaction but also drives loyalty and referrals. A detailed customer journey map empowers insurance businesses to deliver a more personalized and effective service, ultimately leading to improved outcomes for both insurers and their clients.

Extract insights from Customer & Employee Interviews. At Scale.

Understanding the Insurance User Pathway

Understanding the Insurance User Pathway begins with recognizing the various touchpoints a user encounters throughout their journey. This pathway is not linear; it encapsulates the multiple stages from initial awareness to claims processing. Each stage requires a nuanced approach to better understand user needs and preferences, making it crucial for insurance businesses to map these interactions effectively.

At the awareness stage, potential customers discover insurance options through various channels, such as advertisements or recommendations. Once they express interest, they explore offerings, often comparing plans and assessing benefits. Following this research, they enter the consideration phase, where detailed information, customer reviews, and comparisons become pivotal to their decision-making. Finally, after committing to a policy, they may need support during the claims process, which is where a seamless experience can significantly impact user satisfaction. Understanding these dynamics is vital for insurance businesses aiming to enhance user engagement and retention throughout the entire pathway.

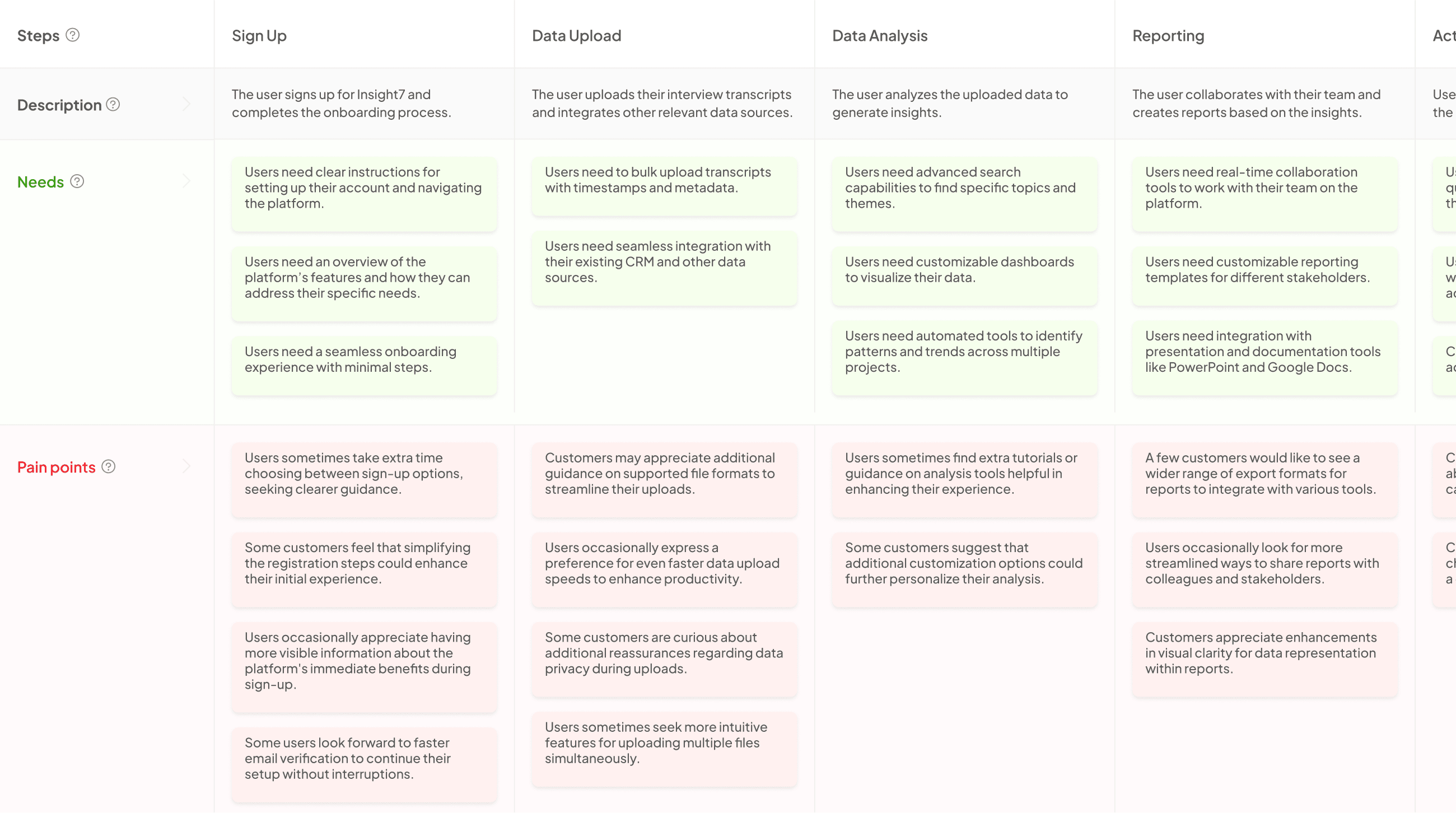

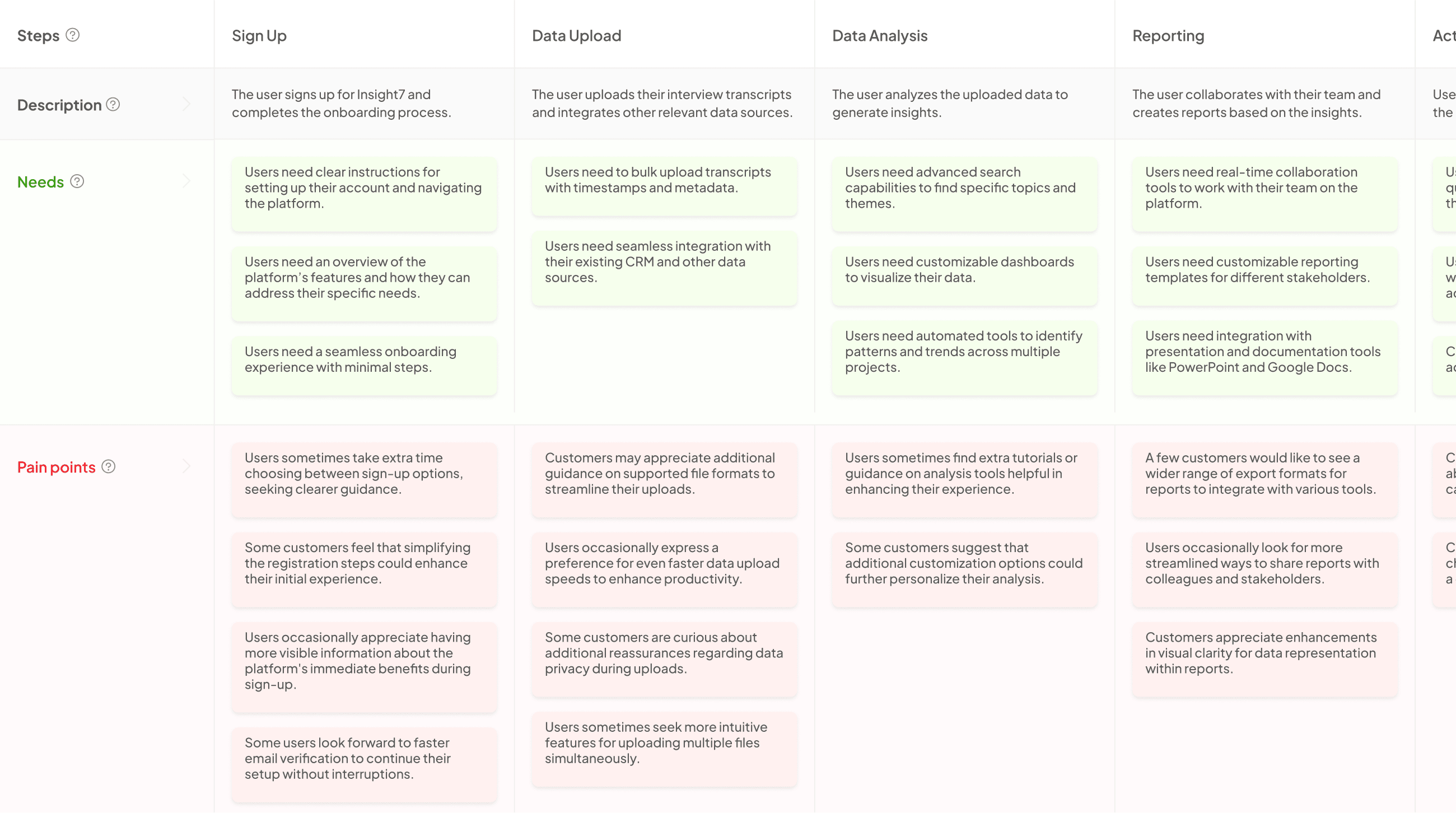

What is a Customer Journey Map?

A customer journey map serves as a visual representation of the pathway that insurance users take from becoming aware of a service to making a purchase. This tool captures essential customer behaviors, emotions, and needs at each stage, providing valuable insight into their decision-making processes.

By mapping this journey, insurance businesses can better understand how customers interact with their offerings, optimizing marketing strategies and communication efforts accordingly.

Creating an effective customer journey map involves several critical steps. First, identify the phases of the insurance user pathway, such as awareness, interest, consideration, and purchase. Each phase highlights specific customer emotions and actions that can guide businesses in addressing their needs.

Second, collaborate with internal teams to ensure everyone shares a unified view of the customer experience. This collective understanding fosters teamwork in refining services, enhancing customer satisfaction, and ultimately driving retention in the competitive insurance market.

Importance of Mapping the Insurance User Pathway

Mapping the Insurance User Pathway is crucial for understanding how customers engage with insurance services. By visualizing this journey, businesses can pinpoint where users face challenges, ensuring a more seamless experience. When customers navigate processes like policy selection or claims filing, obstacles can lead to frustration. Identifying and addressing these pain points through a well-defined pathway aids in fostering trust and satisfaction.

Furthermore, the Insurance User Pathway allows businesses to empathize with their clients. Understanding the emotional landscape at every stage means insurance companies can provide tailored support. For instance, simplifying documentation processes or improving communication during claims can significantly enhance user experience. Ultimately, mapping this pathway is not just about improving operational efficiency but also about building stronger relationships with customers, resulting in increased loyalty and positive referrals.

Key Touchpoints in the Insurance User Pathway

Understanding key touchpoints in the Insurance User Pathway is crucial for enhancing customer experience. These touchpoints represent the moments where potential and existing customers interact with insurance services. From the initial awareness of different coverage options to the finalization of claims, each stage plays a vital role in shaping user perceptions and satisfaction.

Initially, users become aware of insurance offerings through marketing efforts, whether that be social media ads or informative articles. This moment of awareness then transitions into exploration, where users seek more in-depth information about policies and prices. As customers begin to consider their options, user-friendly tools such as online quotes and customer support become essential. Finally, during the purchase phase, a seamless checkout experience ensures that customers feel confident in their choices. By enhancing these key touchpoints, insurance businesses can create a pathway that builds trust and fosters long-term loyalty.

Generate Journey maps, Mind maps, Bar charts and more from your data in Minutes

Awareness and Consideration Stages

In the awareness and consideration stages of the customer journey, potential insurance clients first encounter the services available to them. This initial interaction is crucial as it shapes customer perceptions and ignites interest. At this stage, insurance users become aware of various coverage options through marketing efforts, personal recommendations, or online research. Understanding the emotional and rational factors influencing this phase helps in crafting effective communication strategies.

Once awareness is established, prospective clients transition into the consideration stage, where they actively evaluate their options. Here, customers compare different policies, premiums, and providers, weighing the benefits and drawbacks of each. To gain insights into customer behavior during these stages, qualitative research methods—such as surveys and interviews—are essential. These methods uncover underlying motivations, emotional responses, and any hurdles the customer faces as they navigate their insurance user pathway, ultimately guiding businesses in refining their offerings to meet client needs more effectively.

Purchase and Onboarding Processes

The purchase and onboarding processes are vital phases in the Insurance User Pathway, where customers transition from interested prospects to active policyholders. Initially, the focus is on guiding customers through their purchasing journey. This involves simplifying the decision-making process by clearly presenting options and benefits. Providing various communication channels, such as chat support or informative webinars, helps address customer inquiries effectively.

Once customers complete their purchase, the onboarding experience begins. This phase is crucial for building strong relationships and trust. Clients should receive comprehensive welcome materials outlining their policy details, claims processes, and available resources. Regular follow-ups can ensure customers feel valued and informed, fostering long-term loyalty. By strategically enhancing both purchasing and onboarding processes, insurance businesses can significantly improve customer satisfaction and retention in their Insurance User Pathway.

Enhancing the Insurance User Pathway Experience

Enhancing the Insurance User Pathway experience involves acknowledging the challenges customers face when interacting with insurance services. By mapping out the customer journey, businesses can identify critical touchpoints where users may feel frustrated or confused. Understanding these pain points allows for targeted improvements that can make the insurance process smoother and more user-friendly.

To create a more effective Insurance User Pathway, consider the following steps:

- Gather Insights: Collect data on customer interactions at various stages. This helps to highlight specific areas where users struggle.

- Foster Empathy: Encourage team members to view processes from the customer’s perspective, enhancing understanding and drawing attention to emotional touchpoints.

- Implement Improvements: Make changes based on insights, such as simplifying policy details, streamlining claims processing, and improving communication channels.

- Monitor Impact: Continuously assess the effect of improvements on customer satisfaction and adapt as necessary for ongoing enhancements.

By focusing on these areas, insurance businesses can transform the user experience, build trust, and foster long-term relationships with customers.

Personalization and Customer Engagement

In the context of the Insurance User Pathway, personalization and customer engagement are essential for creating meaningful connections with clients. Tailoring interactions based on customer preferences and behavior helps to increase trust and satisfaction. For example, during the awareness stage, personalized content generated by AI can align product offerings with individual customer interests. This approach ensures that potential clients receive relevant information, encouraging them to explore further.

As customers move into the consideration stage, effective engagement plays a pivotal role. AI can assist in understanding customer needs by facilitating meaningful conversations. Through these dialogues, AI identifies challenges and proposes tailored solutions, enhancing the overall customer experience. Ultimately, incorporating personalized strategies into the insurance customer journey fosters deeper relationships, instills confidence, and boosts retention. In a rapidly changing market, prioritizing personalization will remain vital for success in the insurance sector.

Leveraging Technology and Data Analytics

The Insurance User Pathway is increasingly shaped by advancements in technology and data analytics, enabling insurance businesses to better understand their customers. By utilizing Big Data and artificial intelligence, companies can analyze customer preferences and behaviors to create a more personalized experience. This technological integration allows businesses to anticipate customer needs, fostering a more efficient journey from awareness to decision-making.

AI’s capacity to provide tailored recommendations based on individual user data enhances the overall customer experience. By moving beyond traditional information sources like websites and social media, AI can deliver real-time insights directly to users, significantly altering their interaction with insurance products. Customers can receive automated reviews and suggestions that align with their distinct needs, streamlining the decision-making process. This transformation not only improves customer satisfaction but also drives loyalty, making technology a vital component in shaping the future of insurance services.

Conclusion: Optimizing the Insurance User Pathway for Success

Optimizing the insurance user pathway is essential for businesses aiming to enhance customer experiences. By understanding each touchpoint the customer interacts with, insurance providers can identify key areas where improvements are necessary. For instance, challenges such as complex policy explanations or lengthy claims processes can often lead to frustration. Addressing these pain points helps create a more streamlined journey for customers.

Extract insights from Customer & Employee Interviews. At Scale.

Moreover, implementing user feedback can significantly improve the insurance user pathway. A customer journey map allows businesses to empathize with their clients, understanding their needs and emotions throughout the process. As a result, proactive changes can be made, fostering trust and loyalty. Ultimately, successful optimization enhances customer satisfaction, increases retention rates, and promotes a positive reputation, ensuring long-term success in the competitive insurance market.