Understanding your survey response rates is essential for drawing meaningful insights from your data. However, many face survey calculation pitfalls that can lead to misleading interpretations. Inaccuracies often stem from a lack of clarity regarding basic metrics, such as differentiating between response rates and completion rates. Additionally, failing to properly account for non-responses further complicates the analysis. Recognizing these issues is crucial to ensure a more accurate understanding of your data.

To avoid these pitfalls, begin by clearly defining your key metrics and ensuring that your calculations use consistent data sources. It’s also vital to identify and address non-responses effectively, allowing for adjustments that rectify the incomplete data. By focusing on these strategies, you'll enhance your response rate analysis and ultimately gain deeper insights into your survey outcomes.

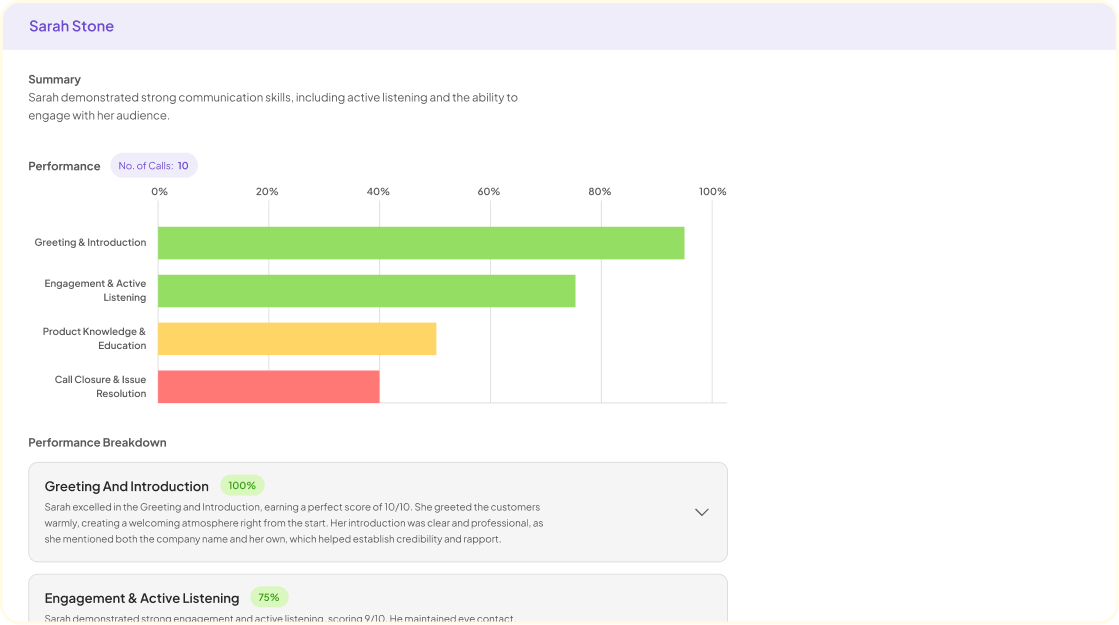

Analyze & Evaluate Calls. At Scale.

Common Survey Calculation Pitfalls in Response Rate

Misunderstanding basic survey metrics is a common pitfall when calculating response rates. Many people confuse response rate with completion rate, which can lead to significant errors in interpretation. The response rate measures how many individuals completed the survey versus those invited, while the completion rate focuses on those who finished the survey without skipping questions. Clear distinctions between these metrics are essential for accurate reporting and analyses.

Another prevalent issue surrounds the miscalculation of numerators and denominators in response rate formulas. It’s crucial to use consistent and accurate data in both parts of the calculation. Additionally, overlooking non-responses can skew results. Not recognizing the different types of non-responses hinders your ability to adjust data properly. Be sure to categorize non-responses and implement adjustment techniques for incomplete data to enhance the integrity of your survey results. By addressing these survey calculation pitfalls, you can ensure more reliable data and insights.

Misunderstanding Basic Survey Metrics

Misunderstanding basic survey metrics can lead to significant survey calculation pitfalls that skew the interpretation of results. One common error arises from confusing response rates with completion rates. The response rate measures how many participants answered the survey, while the completion rate indicates how many completed it fully. This distinction is vital for understanding the depth and quality of the data collected.

Another common pitfall is the incorrect identification of the numerator and denominator in calculations. Often, organizations fail to maintain consistency in the data they use, which can result in misleading figures. For instance, if you're including all survey invitations in the denominator but only counting completed responses as the numerator, the reported response rate will be inaccurately inflated. By taking time to clarify these essential metrics, you can ensure a more accurate and meaningful analysis of your survey results.

- Step 1: Define Key Metrics

Defining key metrics is a fundamental step in avoiding survey calculation pitfalls. Understanding the difference between response rate and completion rate is crucial. The response rate measures how many respondents participated in your survey compared to the total number of individuals invited to participate. In contrast, the completion rate indicates how many respondents finished the survey compared to those who started it. Failing to differentiate between these metrics can lead to misguided conclusions about your survey's effectiveness.

To further refine your analysis, it’s important to establish clear definitions for these metrics. This involves setting boundaries around what constitutes a completed response and ensuring you are measuring them accurately over time. By committing to a consistent approach in defining these key metrics, you will pave the way for more reliable calculations, helping you to identify areas needing improvement. Remember that precision at this stage sets the foundation for effective data analysis insights.

- Explanation of response rate vs. completion rate

Understanding the difference between response rate and completion rate is crucial in survey analysis. Response rate refers to the percentage of people who participated in your survey compared to the total number of individuals you initially targeted. On the other hand, the completion rate measures how many respondents finished the survey compared to those who started it. Miscalculating these rates can lead to misleading insights, thus highlighting the importance of accurate data interpretation in your survey calculation pitfalls.

In practice, many overlook these distinctions. For example, a high response rate with a low completion rate may indicate that while people are willing to engage, they find the survey too lengthy or complex. To avoid common mistakes in survey response rate calculation, ensure that you clearly define what each metric represents, keeping in mind the influence of survey design on participant behavior. This clarity not only helps in making informed decisions but also aids in improving future surveys.

- Step 2: Clarify Numerator and Denominator

Understanding the structure of your survey response calculations is crucial to avoid common survey calculation pitfalls. The numerator and denominator play significant roles in determining your survey response rate. The numerator typically represents the number of completed surveys, while the denominator encompasses the total number of participants contacted. Misunderstanding these components can lead to inaccuracies in your calculations, which in turn can distort insights drawn from the data.

To clarify, always check that your numerator reflects the respondents who completed the survey, not merely those who started it. Similarly, ensure your denominator includes all eligible participants, accounting for any adjustments, such as those unreachable or opting out. Misalignment in these metrics may skew your results, leading to poor decision-making. Clear definitions and consistent data are key to reliable calculations. Take the time to equalize these components, ensuring a valid and informative response rate that truly reflects participant engagement.

- Importance of using consistent data in calculations

Using consistent data in calculations is crucial for achieving accurate survey response rates. When varying data sets are combined without a clear understanding, it leads to potential misinterpretations that can skew results. This becomes particularly evident when comparing response rates across different demographics or time periods, as discrepancies in how data is collected and categorized can arise. Consistent data ensures reliable comparisons and valid conclusions, forming the backbone of any analysis you undertake.

Moreover, maintaining uniformity across your data set allows for streamlined calculations and reduces the likelihood of errors. Utilizing mismatched definitions for terms such as "respondent" or "response" can create significant pitfalls. Addressing these discrepancies early on paves the way for clearer insights and better strategic decisions. By prioritizing consistent data, you mitigate risks associated with survey calculation pitfalls, ensuring that your findings are both actionable and trustworthy.

Overlooking Non-responses

Non-responses can significantly skew the results of your survey, leading to misleading insights and flawed decision-making. The key to accurate survey calculation lies in recognizing these non-responses as a critical variable. When individuals do not respond to your survey, it is essential to categorize these non-responses effectively. Understanding whether they stem from lack of interest, accessibility issues, or timing can enhance your analysis, allowing you to strategize better engagement methods in future surveys.

Once you identify the sources of non-responses, implementing adjustments becomes crucial. Techniques such as weighting your survey data or using imputation methods can help counterbalance the effects of missing responses. These adjustments give a more accurate representation of your target population and enhance the reliability of your findings. By addressing non-responses, you avoid unnecessary survey calculation pitfalls and improve the quality of insights gained from your data.

- Step 1: Identify Sources of Non-response

Identifying sources of non-response is crucial for accurate survey response rate calculations. Understanding the reasons behind participant disengagement can help mitigate its impact. First, consider the category of non-responses, which typically includes complete non-participation, partial answers, and survey drop-outs. Each of these areas can significantly skew your results. For example, if many respondents abandon the survey midway, it may signal issues with survey length or clarity, which need immediate addressing.

Next, analyzing the demographic breakdown of your non-respondents can provide valuable insights. Different groups often have varying levels of engagement, and recognizing these disparities allows for targeted adjustments. Additionally, technical issues such as accessibility or compatibility may deter participation. By identifying these sources, you can tailor your approach to improve engagement and minimize survey calculation pitfalls, ensuring a more reliable dataset for analysis.

- Categories of non-responses to consider

Understanding the categories of non-responses is crucial when calculating survey response rates accurately. Non-responses can stem from various factors, each representing a different challenge in data analysis. First, you have the 'Inaccessibility' category. This occurs when the survey reaches individuals who cannot participate due to language barriers or technical difficulties. Secondly, 'Refusals' are when respondents choose not to engage with the survey intentionally, possibly due to survey fatigue or privacy concerns.

Another important aspect is 'Incomplete Responses,' where participants start the survey but fail to complete it. This compromises the data quality significantly. Finally, consider 'Sampling Error,' which arises when the selected sample does not represent the broader population accurately. Recognizing these categories helps avoid common survey calculation pitfalls, ensuring that your data remains reliable and insightful. By implementing targeted strategies to address these non-responses, you can enhance the overall quality of your survey analysis.

- Step 2: Implementing Adjustments

Implementing adjustments is a critical step in overcoming survey calculation pitfalls, especially regarding non-responses. Begin by analyzing the factors contributing to incomplete data. This analysis allows you to identify trends and patterns in participant feedback, which can then inform your adjustments. For example, if you notice low response rates from a specific demographic, consider modifying your outreach strategies to engage them effectively.

Next, apply techniques such as weighting responses based on demographic factors or using statistical methods to estimate responses for non-respondents. This ensures that your data accurately reflects the target population. Additionally, consider conducting follow-up surveys or utilizing incentives to boost response rates among reluctant participants. By taking these steps to adjust for missing data, you enhance the validity of your findings and improve overall response rates. Remember, consistent evaluation and adaptation are key to overcoming common survey calculation pitfalls.

- Techniques to adjust for incomplete data

When addressing survey calculation pitfalls, particularly around incomplete data, recognizing the impact of non-responses is crucial. One effective technique is imputation, which estimates missing values based on existing data. This allows for a more comprehensive analysis by filling in the gaps, reducing bias, and improving overall accuracy. Another method to consider is weighting, which adjusts the influence of responses to reflect the target population proportions better. By applying weights, you acknowledge varying response rates across different demographics, enhancing the representativeness of your findings.

Additionally, sensitivity analysis helps assess how adjustments for incomplete data influence your results. By systematically evaluating outcomes under different scenarios, you can identify potential vulnerabilities in your conclusions. Developing a robust strategy for incomplete data improves the quality of your survey results and helps to avoid common survey calculation pitfalls that may arise from these discrepancies. Ensuring clarity in your approach will ultimately lead to more dependable insights.

Extract insights from interviews, calls, surveys and reviews for insights in minutes

Tools to Navigate Survey Calculation Pitfalls

Navigating survey calculation pitfalls effectively requires the right tools and insights. Utilizing specialized platforms can significantly streamline the response rate calculation process, helping analysts minimize errors. For instance, insight7 offers intuitive features that simplify the analysis of survey data. It assists users in accurately determining response rates by clearly presenting results and integrating them into a broader analytical context.

Additionally, other tools such as Survey Monkey, Google Forms, Qualtrics, and Typeform provide unique benefits tailored to diverse survey needs. Survey Monkey excels in offering customizable templates, making it easy to design surveys that improve participation. Google Forms integrates well with data analysis tools, allowing for real-time analysis of responses. Meanwhile, Qualtrics automates extensive data analysis, while Typeform's user-friendly interface enhances participant engagement, resulting in higher response rates. Using these tools can help ensure that survey calculations are precise and informative, ultimately leading to richer insights.

insight7

Accurate survey response rate calculation is essential for understanding user feedback and making informed decisions. However, many professionals fall into common survey calculation pitfalls that can skew their results. Recognizing these pitfalls involves a keen awareness of how survey metrics are defined and interpreted. Often, the distinction between response rate and completion rate is unclear, leading to flawed calculations that misrepresent data.

Additionally, overlooking non-responses can significantly impact the results. It is crucial to identify the sources of non-response, such as lack of interest or incomplete submissions, and to implement adjustments that account for these gaps in data. By addressing these issues, organizations can ensure their survey calculations reflect true user engagement. Understanding these adjustments not only improves the accuracy of the response rate but also reinforces the reliability of insights derived from survey data.

- Explanation of its features and how it assists in accurate survey calculations.

Insight7 is a powerful tool designed to streamline accurate survey calculations, helping users avoid common pitfalls. Its data visualization features enable users to extract critical insights, revealing both positive and negative customer feedback. By organizing data effectively, it simplifies analysis, making it easier to identify trends and significant patterns. This capability is essential in overcoming survey calculation pitfalls, particularly when assessing response rates.

Moreover, Insight7 provides collaborative options that allow for real-time querying across datasets, enhancing comprehension. Users can compare responses from different locations or demographics, ensuring a more thorough understanding of survey results. By facilitating direct access to data and fostering a collaborative environment, this tool empowers teams to make informed decisions based on clear, actionable insights—vital when addressing survey calculation pitfalls. Ultimately, Insight7 enhances accuracy in survey response rate calculations, bridging gaps often left unaddressed in traditional approaches.

Additional Tools for Accurate Survey Calculations

Accurate survey calculations hinge on using the right tools to avoid common pitfalls. Understanding these pitfalls can drastically improve your survey outcomes, especially when examining response rates. Various software options exist to enhance the calculation process, each with unique features tailored to specific needs. Familiarizing yourself with effective tools will facilitate better data collection, analysis, and ultimately, decision-making.

Survey Monkey: This tool is renowned for its user-friendly interface, allowing you to create surveys quickly. It also provides in-depth analytics, helping you easily interpret response rates.

Google Forms: A versatile tool that integrates seamlessly with other Google services, enabling straightforward data analysis. You can swiftly visualize your responses with Google Sheets for deeper insights.

Qualtrics: This advanced platform offers sophisticated analysis tools and automation capabilities that streamline your survey processes. It’s ideal for businesses needing high-level data insights.

Typeform: Known for its engaging design, Typeform enhances user experience by creating visually appealing surveys. Its analytical features allow you to track response rates effectively.

Using these tools can mitigate survey calculation pitfalls, ensuring you derive actionable insights from your data.

- Tool 1: Survey Monkey

When it comes to avoiding survey calculation pitfalls, the right tools can make a significant difference. Survey Monkey stands out as a user-friendly platform that simplifies the survey creation process while also offering robust analytics features. It allows users to customize questions and formats, ensuring that they gather the information that truly matters for their analysis. This customization aids significantly in tracking metrics, which can prevent misunderstandings that often arise from poorly defined surveys.

A major common mistake in survey response rate calculations is not accurately considering the distinctions between baseline metrics like response rate and completion rate. Users can conveniently visualize these metrics in Survey Monkey, helping clarify the numerator and denominator for their calculations. Furthermore, the platform offers features to identify and analyze non-responses, highlighting areas where adjustments may be needed. These capabilities not only enhance data reliability but also empower users to address gaps, ultimately leading to more actionable insights.

By utilizing Survey Monkey, you can navigate the complexities of survey response rate calculations while avoiding the common pitfalls that can distort your data.

- Benefits and use cases

Understanding the benefits and use cases of effectively calculating survey response rates is essential to gathering reliable data. Addressing Survey Calculation Pitfalls can dramatically enhance the overall efficiency of your research efforts. Firstly, accurate response rate calculations help identify where improvements can be made in your surveys. For instance, recognizing which demographic engages more can guide targeted outreach strategies.

Moreover, businesses can leverage insights obtained through sound survey response analysis to drive marketing strategies. By detecting trends or gaps in the data, organizations can tailor their offerings more effectively. Improved response rates result in higher-quality feedback, allowing for better decision-making. Ultimately, avoiding common pitfalls in survey response rate calculations can lead to actionable insights that greatly benefit an organization in refining products, enhancing customer service, or optimizing marketing campaigns.

- Tool 2: Google Forms

Google Forms serves as a powerful tool to navigate the common pitfalls in survey response rate calculation. Its user-friendly interface allows for the creation of custom surveys that can reach a wide audience efficiently. However, many users overlook critical aspects of utilizing Google Forms, resulting in inaccurate survey response evaluations. For instance, lacking clarity in the questions can lead to incomplete responses, skewing the data.

To avoid survey calculation pitfalls, the integration capabilities of Google Forms should be fully utilized. By linking the responses to data analysis tools, users can consolidate information to gain deeper insights. Additionally, setting up automatic reminders for participants ensures a higher response rate. This proactive approach not only mitigates misunderstandings surrounding key metrics like response rates but also bolsters the validity of the collected data. In essence, leveraging Google Forms effectively can significantly enhance the accuracy of your survey calculations.

- Integration with data analysis tools

Integrating data analysis tools into your survey response rate calculation process can greatly enhance accuracy and insights. By utilizing specialized software, you mitigate common survey calculation pitfalls significantly. For instance, using cohesive data integration capabilities to ensure your metrics align accurately can prevent misunderstandings related to basic survey metrics. Advanced tools can also seamlessly gather responses, ensuring that your numerator and denominator are consistent in your calculations.

Moreover, visualization features present trends and patterns from your data, helping you identify sources of non-responses effectively. Tools like SurveyMonkey and Qualtrics offer valuable functionalities that automate data analysis, reducing the chances of human error. This integration allows you to quickly pinpoint areas needing adjustments based on the collected data and ensures comprehensive analysis. Utilizing these tools not only streamlines your process but also aids in producing reliable results that inform decision-making. Proper integration can lead to improved survey outcomes and a better understanding of user behavior.

- Tool 3: Qualtrics

Qualtrics stands out as a robust tool for addressing survey calculation pitfalls. Its sophisticated features facilitate the accurate measurement of response rates, minimizing common mistakes. Users often fall into traps such as miscalculating response rates by failing to distinguish between the various metrics involved. With Qualtrics, you can easily define your key metrics, ensuring a clear understanding of the difference between response rates and completion rates.

Moreover, the integration of automated analytics makes it simpler to identify sources of non-responses. Qualtrics allows researchers to categorize non-responses effectively, enabling adjustments for incomplete data. This ensures that the denominator in any statistical analysis reflects the actual target audience, enhancing the reliability of your results. By engaging with Qualtrics, you can ultimately transform your survey strategies and sidestep the survey calculation pitfalls that many encounter in their data analysis journey.

- Analysis features and automation

In today's data-driven environment, understanding analysis features and automation is critical for improving survey response rates. Many organizations struggle with survey calculation pitfalls due to manual methods that obscure accuracy. Automating the collection and reporting of response metrics minimizes human error, enabling easier identification of trends and insights. This not only enhances efficiency but also provides a robust framework for ongoing evaluations.

Implementing advanced features—such as real-time dashboards and automated reporting—allows teams to monitor response rates continuously. When automated systems are in place, organizations can quickly adjust strategies based on responsive feedback. These features streamline the process, reducing the risk of miscalculations that often arise from traditional methods. By harnessing automation, entities can focus on interpreting results, leading to more informed decision-making and ultimately higher survey engagement.

- Tool 4: Typeform

Typeform stands out as an intuitive tool designed to enhance the survey-taking experience. Its user-friendly interface allows for seamless question design that encourages participant engagement. However, users must be wary of survey calculation pitfalls, particularly when interpreting response rates. An attractive layout does not guarantee accurate data collection or analysis.

When creating surveys, it is essential to define your target audience clearly and ensure your questions are straightforward. Typeform provides analytics that can help assess response patterns and completion rates, but it's crucial to understand how to interpret these metrics. Moreover, overlooking non-responses can skew your results significantly. Utilize Typeform's integrations to collect and adjust for non-response bias. With attention to these details, you can effectively harness Typeform's capabilities to achieve meaningful insights while avoiding common miscalculations.

- User-friendly design and analytics capacity

Creating a user-friendly design is essential for enhancing survey engagement and improving response rates. A streamlined interface encourages more participants to complete surveys, minimizing potential drop-offs. Utilizing visual elements, such as intuitive navigation and clear question layouts, can greatly enhance the user experience. When the survey is easy to understand, it lowers the barrier for respondents and increases the likelihood of better data collection.

Moreover, developing strong analytics capacity will empower you to delve deeper into the collected data. By utilizing analytics tools, you can identify trends and patterns that might otherwise go unnoticed. This capacity enhances your ability to draw actionable insights from the responses you gather. Without focusing on user-friendly design and robust analytical capabilities, you risk encountering significant survey calculation pitfalls, ultimately compromising the reliability of your findings. Emphasizing these aspects will lead to more effective survey processes and meaningful data interpretation.

Conclusion: Mastering Survey Calculation Pitfalls for Reliable Data

Mastering survey calculation pitfalls ensures that the data you gather yields trustworthy insights. Recognizing common errors in calculating response rates, such as confusing metrics or ignoring non-responses, significantly enhances the accuracy of your findings. By implementing best practices in data analysis and utilizing effective tools, you create a solid foundation for future research efforts.

Ultimately, awareness of these pitfalls empowers you to navigate the complexities of survey response rates. Continually refining your approach leads to more reliable data, informing decisions and strategies that affect your organization positively. Embrace this knowledge to drive successful survey outcomes and achieve meaningful results.