In the realm of call centers, the challenge of data security looms large as organizations handle sensitive customer information daily. The introduction of an AI-Driven Risk Shield is a game-changer, offering a sophisticated approach to safeguarding confidential data and enhancing compliance standards. By utilizing advanced algorithms, this system monitors interactions, identifies risks, and provides actionable insights, fostering a proactive environment in which issues can be addressed before they escalate.

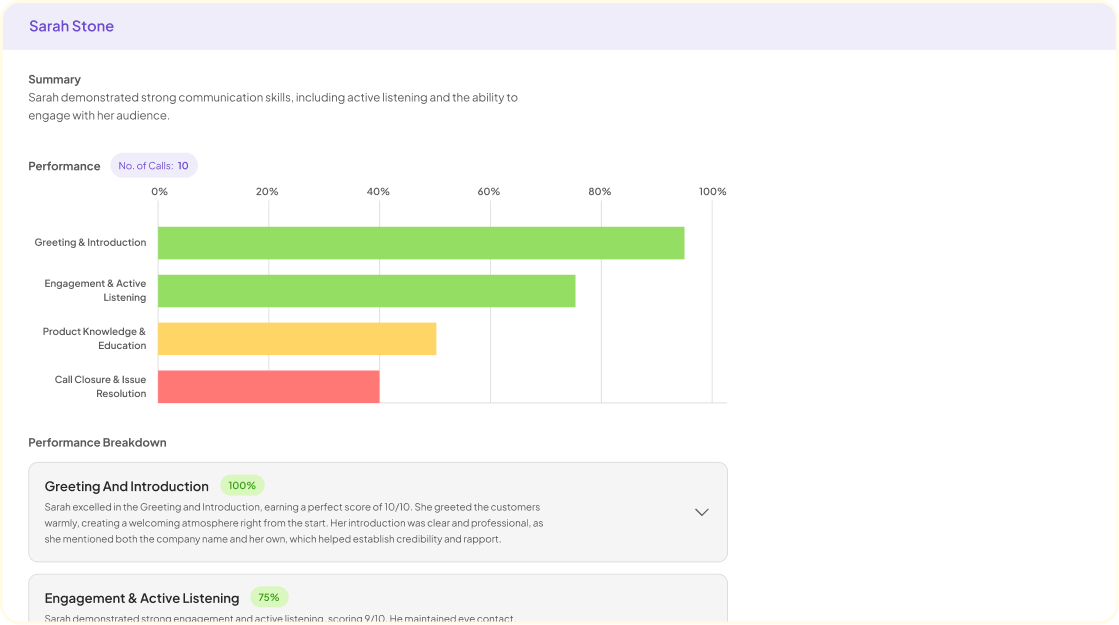

The AI-Driven Risk Shield not only streamlines workflow but also elevates the standard of customer service. Call centers can assess agent performance and customer engagement through detailed analytics, ensuring that operational protocols are consistently followed. With the rise of digital threats, adopting such an innovative solution fortifies defenses and builds customer trust, ultimately leading to a more resilient call center environment.

Analyze & Evaluate Calls. At Scale.

Understanding AI-Driven Risk Shield in Data Protection

Artificial intelligence plays a critical role in shaping the AI-Driven Risk Shield, which significantly enhances data protection for call centers. This innovative technology focuses on identifying potential risks, analyzing data, and implementing strategies to mitigate threats. By continuously monitoring interactions, it can detect patterns and anomalies, which assists in proactively addressing security vulnerabilities.

Moreover, the AI-Driven Risk Shield empowers call centers to maintain compliance with data protection regulations. It generates detailed reports that are crucial for compliance officers, enabling them to take informed actions. This functionality is essential for improving organizational resilience against data breaches, ensuring trust between businesses and their customers. In essence, the AI-Driven Risk Shield not only strengthens security frameworks but also fosters a culture of accountability and transparency within the call center environment.

The Need for AI-Driven Risk Shield in Call Centers

In today's fast-paced call center environment, the need for an AI-Driven Risk Shield is more critical than ever. As call centers handle sensitive customer data, they risk exposing themselves to various security threats, including data breaches. Traditional risk management methods often fall short in efficiently addressing these growing challenges. AI technology offers a transformative solution, enabling organizations to proactively monitor and mitigate risks associated with data protection.

Implementing an AI-Driven Risk Shield can streamline training processes and improve compliance among customer service representatives. By analyzing call data, the system identifies patterns that highlight potential risks and areas for improvement. This not only reduces the time spent on manual assessments but also empowers teams to respond more effectively to customer inquiries. Consequently, organizations gain valuable insights into customer behaviors, enabling them to enhance service quality and strengthen their overall data security framework.

How AI-Driven Risk Shield Enhances Data Security

The AI-Driven Risk Shield serves as a vital component in enhancing data security for call centers. By effectively analyzing communication patterns, it identifies potential threats and vulnerabilities that could compromise sensitive information. This proactive approach minimizes risks before they escalate into critical issues, safeguarding both customer data and organizational integrity.

Additionally, the AI-Driven Risk Shield employs advanced algorithms to monitor compliance with data protection regulations. This ensures that agents adhere to privacy standards during interactions, thereby reducing the likelihood of data breaches. Through real-time insights, organizations can make informed decisions regarding data handling and security measures. Ultimately, implementing an AI-Driven Risk Shield not only fortifies data protection but also fosters trust among clients, demonstrating a commitment to confidentiality and security in the call center environment.

Extract insights from interviews, calls, surveys and reviews for insights in minutes

AI-Powered Tools for Risk Management

AI-Powered Tools for Risk Management play a crucial role in enhancing data protection within call centers. These advanced tools employ sophisticated algorithms to analyze vast amounts of data in real-time. By doing so, they can identify potential risks and vulnerabilities before they escalate into significant issues. The integration of AI technology ensures that call centers can safeguard sensitive customer information effectively while maintaining compliance with regulations.

One of the standout features of these AI-powered tools is their ability to automate risk assessment processes. This leads to improved efficiency and accuracy in identifying data threats. Additionally, they provide actionable insights, allowing decision-makers to promptly address any concerns that arise. By leveraging AI-Powered Tools for Risk Management, call centers can foster a culture of security and accountability, which is essential in today's data-driven environment. Embracing such technology not only protects customer data but also enhances overall operational resilience.

Leading AI Tools for Call Center Data Protection

In the realm of call center data protection, leading AI tools play a pivotal role in ensuring security and compliance. Among these, the AI-Driven Risk Shield stands out, offering innovative solutions that protect sensitive customer information. This advanced tool utilizes machine learning algorithms to identify potential risks, enabling businesses to act swiftly and effectively. By analyzing call data in real-time, it can flag irregularities, providing critical insights that enhance overall data security.

Several prominent tools contribute to this landscape. First, tools like CallMiner facilitate the analysis of customer interactions to uncover patterns and vulnerabilities. Next, Observe.AI transforms unstructured data into actionable insights, enriching compliance efforts. Lastly, NICE inContact integrates analytics with customer feedback, ensuring a holistic approach to data protection. The adoption of these AI-driven solutions equips call centers with the resources necessary for a robust data protection strategy, ultimately fostering trust and safety in customer interactions.

insight7

AI-Driven Risk Shield plays a critical role in modern call centers that prioritize data protection. Call centers generate extensive data from customer interactions but face challenges in managing this data securely. AI-Driven Risk Shield technology analyzes call records in real-time, identifying potential risks and vulnerabilities in data handling.

One of the core advantages of the AI-Driven Risk Shield is its ability to automate risk assessments continuously. This innovation allows organizations to respond quickly to emerging threats, minimizing the chances of data breaches. Furthermore, by centralizing insights from scattered data, it enhances collaboration across teams, ensuring that all stakeholders are informed and engaged in risk management.

Moreover, these AI-driven platforms help streamline compliance requirements, enabling organizations to adhere to regulations effortlessly. Ultimately, embracing an AI-Driven Risk Shield is essential for call centers aiming to secure sensitive customer data while enhancing operational efficiency.

Tool 2: CallMiner

CallMiner offers innovative capabilities that make it a standout tool for call center risk management. Its AI-Driven Risk Shield is designed to analyze conversations at scale, ensuring compliance while identifying potential risk areas. CallMiner sorts through thousands of calls, allowing managers to focus on relevant interactions based on risk factors such as compliance violations. This targeted approach helps organizations address issues proactively, enhancing their training and development processes.

Additionally, CallMiner enables detailed insights into agent performance and customer experience. By auditing calls systematically, it brings transparency to the conversation, empowering decision-makers with actionable data. In this way, it not only safeguards against regulatory risks but also fosters an atmosphere of continuous improvement. With CallMiner, businesses can harness the power of AI to create a strategy that emphasizes data protection and regulatory adherence in their call center operations.

Tool 3: Observe.AI

Tool 3: Observe.AI is a crucial player in enhancing call center data protection. As a component of an AI-Driven Risk Shield, it provides advanced capabilities in analyzing call data and agent performance. By employing natural language processing and machine learning, this tool enables real-time monitoring and evaluation of conversations, detecting compliance issues promptly. Its ability to generate detailed performance reports lets managers track engagement metrics against predefined benchmarks.

This tool also facilitates quick access to actionable insights, empowering compliance officers to refine training and support strategies. The editing functionality of generated reports ensures that compliance documentation remains accurate and tailored to specific needs. In a world where data protection is paramount, integrating Observe.AI within your risk management framework not only helps secure sensitive information but also optimizes overall operational efficiency. With its user-friendly interface, you can achieve significant improvements in both data security and customer service quality.

Tool 4: NICE inContact

NICE inContact stands out as a pivotal tool in the arsenal of AI-driven risk management software, particularly within call centers. It empowers organizations to not just protect data but to unearth actionable insights from interactions at scale. By leveraging advanced analytics, this tool enhances the capability to manage risks effectively while maintaining compliance with data protection regulations.

The platform allows users to analyze vast amounts of call data efficiently. This ensures that identifying potential vulnerabilities happens in real time, thus reshaping the traditional approach to risk management. Another significant advantage is its ability to foster collaboration across teams, ensuring that everyone is on the same page when it comes to data security protocols. With NICE inContact, organizations can seamlessly transition from reactive to proactive stances in their risk mitigation strategies, thus reinforcing their commitment to customer trust.

Conclusion: The Future of AI-Driven Risk Shield in Call Centers

The adoption of an AI-Driven Risk Shield in call centers marks a transformative shift in data protection practices. As organizations face increasing challenges regarding data security and compliance, leveraging AI-powered solutions becomes paramount. These advanced technologies enable real-time monitoring of interactions, enhancing the accuracy of compliance reports and agent evaluations. This capability not only safeguards sensitive information but also streamlines operational efficiency.

Looking ahead, the role of AI-Driven Risk Shields will expand further, integrating more sophisticated analytics and customizable reporting features. As call centers evolve, these innovations will empower teams to mitigate risks proactively. Embracing AI-driven solutions will not only ensure compliance but also foster a culture of trust and reliability, positioning organizations favorably in an increasingly competitive landscape.